Let's get real for a second: if you're building your MSP with the fantasy that a fat top-line revenue number is your golden ticket to a lucrative exit, you're setting yourself up for a rude awakening.

I've watched too many MSP owners pat themselves on the back for crossing that magical $3M, $5M, or $10M revenue threshold, only to discover that buyers aren't exactly lining up to throw money at them. Why? Because sophisticated acquirers aren't impressed by vanity metrics. They're looking at what actually drives sustainable value.

So let's cut through the noise. Here are the seven things buyers are really evaluating when they consider acquiring your MSP, and yeah, revenue doesn't even crack the top spot.

1. Profitability (EBITDA) Is King

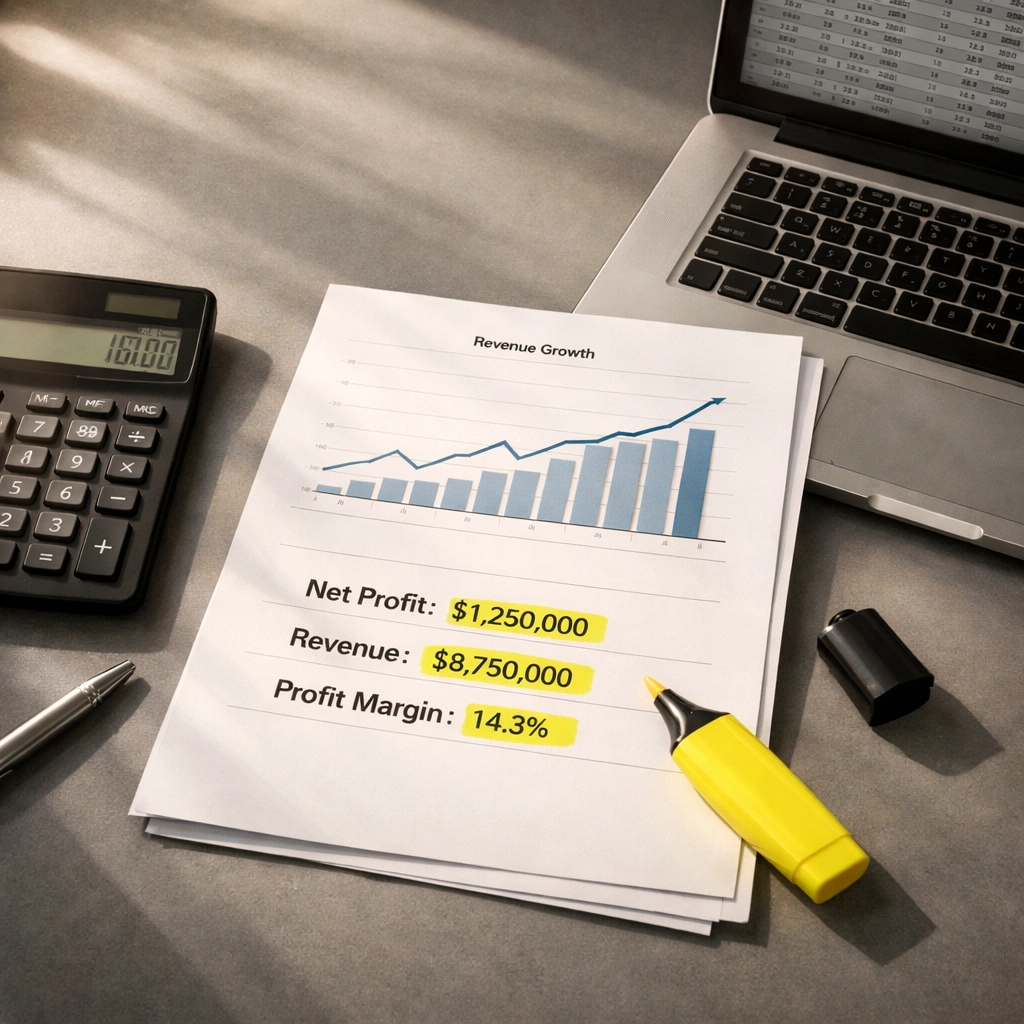

Here's the truth bomb: buyers care about EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization) way more than they care about your revenue. It's the #1 factor they assess because it shows them what kind of cash flow the business actually generates.

But here's where it gets interesting. Not all EBITDA is created equal. A company with 15% net profit margin might command a 5x EBITDA multiple, while a company with 10% margin only gets 4x: even if they have the exact same EBITDA number.

Translation? Clean, healthy profitability matters more than just hitting a revenue target. If you're doing $5M in revenue but only keeping $250K (5% margin), you're nowhere near as attractive as the $3M company keeping $600K (20% margin).

Stop chasing revenue for revenue's sake. Focus on what you actually get to keep.

2. Recurring Revenue That's Actually Recurring

Monthly Recurring Revenue (MRR) isn't just a nice-to-have KPI: it's the lifeblood that makes your MSP attractive to buyers. They want predictable, stable cash flow, not a business that depends on one-off projects and break-fix chaos.

Here's what buyers dig into:

- What percentage of your revenue is truly recurring?

- How sticky are those contracts?

- Are you month-to-month or locked into multi-year agreements?

If a significant chunk of your revenue comes from project work or ad-hoc services, that's a red flag. Buyers want to see that you've built a service-driven business that generates consistent income without constantly hustling for the next sale.

Think of it this way: buyers aren't buying your hustle. They're buying your machine.

3. Customer Retention and Low Churn

You know what scares the hell out of buyers? Leaky buckets.

If customers are constantly churning out the back door while you're frantically trying to bring new ones in the front, you don't have a sustainable business: you have an expensive hamster wheel. And nobody wants to buy a hamster wheel.

Buyers examine your customer retention rates and churn numbers with a microscope. Low churn signals customer satisfaction, strong service delivery, and business stability. High churn? That's a valuation killer.

The best MSPs we work with at Encore Strategic obsess over retention metrics. They know their churn rate down to the decimal point, and they've built systems to keep customers happy and sticky for years.

What's your annual churn rate? If you don't know off the top of your head, that's problem number one.

4. Operational Efficiency and Scalability

Can your business run without you micromanaging every detail? That's what buyers want to know.

They're looking for MSPs that function as "well-oiled machines": businesses with documented processes, efficient service delivery models, and the capacity to scale without proportionally increasing headcount or owner involvement.

Here's what operational maturity looks like:

- Standard operating procedures (SOPs) that actually get used

- Service delivery metrics that prove efficiency (tickets per tech, resolution times, etc.)

- Reasonable customer acquisition costs (CAC)

- A tech stack that enables automation, not manual grunt work

Larger MSPs typically command higher multiples because they've proven they can scale efficiently. But size alone isn't the secret sauce: it's the systems and processes that make growth profitable and predictable.

If you're still the chief problem-solver, head salesperson, and primary escalation point, you haven't built a sellable business. You've built yourself a job.

5. Specialization Over Generalization

Hot take: being a jack-of-all-trades MSP is leaving serious money on the table.

Buyers pay premium multiples for specialized MSPs because specialization signals expertise, predictability, and competitive moat. When you serve a specific vertical or focus on high-demand areas like cybersecurity or cloud services, you're not just another commodity provider in a race to the bottom.

Specialized MSPs demonstrate:

- Deep industry knowledge that's hard to replicate

- Refined service delivery processes for specific client types

- Higher perceived value (and therefore better pricing power)

- More stable, predictable revenue streams

The generalist MSP trying to be everything to everyone? They're competing on price, struggling with client retention, and fighting an uphill battle for respectable margins.

Want to know what happens to value when you specialize? Let's just say the difference isn't subtle.

6. Clean Financials and Transparent Accounting

Nothing kills a deal faster than messy books.

Buyers want financial statements they can actually understand: clean numbers showing revenue, expenses, and profit without your personal expenses, your spouse's car payment, or your kid's college tuition mixed in.

Here's what financial maturity looks like:

- Clear separation between business and personal expenses

- Realistic owner compensation (not artificially low to inflate EBITDA)

- Well-documented add-backs that buyers will actually accept

- Financial statements that tell a consistent, believable story

Pro tip: if you're paying yourself $50K a year while doing the work of a CEO, buyers will adjust your EBITDA downward to reflect what it would actually cost to replace you. That "impressive" EBITDA number? It just got a haircut.

Get your books clean now, not six months before you want to sell. Because scrambling to untangle financial chaos while trying to close a deal? That's a special kind of nightmare.

7. Demonstrated Growth Potential

Buyers aren't just buying your past performance: they're buying your future. They want to see that you've got runway left, not that you've already maxed out your market opportunity.

What demonstrates growth potential?

- Quality customer base with room to upsell

- Clear visibility into your sales pipeline

- Proven ability to acquire and retain customers profitably

- Market positioning that isn't maxed out or declining

If you've already saturated your addressable market, squeezed every dollar out of your existing clients, and have no clear path to expansion, buyers will price that in (and not in a good way).

The sweet spot? You've built something valuable and there's obvious opportunity for the right buyer to take it even further.

The Bottom Line

Look, building a valuable, sellable MSP isn't about gaming the system or polishing a turd right before you hit the market. It's about intentionally building a business that works, scales, and generates predictable profit: with or without you in the driver's seat every day.

These seven factors aren't just acquisition criteria. They're also the markers of a healthy, sustainable business that's probably a lot more enjoyable to run than the alternative.

Whether you're planning to exit next year or ten years from now, focusing on these fundamentals makes your business stronger today and more valuable tomorrow. That's not just smart exit planning: it's smart business, period.

Want to understand where your MSP stands on the value spectrum? We help MSP owners build businesses designed around these exact principles. Check out our Profit. Grow. Exit. framework or book a conversation to talk through your specific situation.

Because at the end of the day, the best time to start building value isn't when you decide to sell. It's right now.